Beware of Fake Loan Scams: Residents of the Susquehanna Valley have recently been targeted by a growing wave of fake loan scams, as scammers try to lure unsuspecting individuals into revealing their personal information. These fraudulent schemes involve leaving alarming voicemail messages claiming the recipient is approved for a large loan they never applied for, with exorbitant monthly payments attached. The goal? To trick victims into calling back and divulging sensitive personal data.

One such case was reported by a local viewer named Dayna, who forwarded a suspicious voicemail to WGAL News 8. The message claimed that Dayna’s “file is nearly approved” for a $63,000 loan on a 60-month term with no origination fee. The voicemail went further, stating that the monthly payment for this loan would be more than $12,000 per month.

This alarming tactic is designed to scare recipients into action. The scammers hope that the prospect of such a massive and unwanted financial burden will prompt the individual to call back. That’s when they ask for critical personal information like Social Security numbers, bank account details, and other private data, all of which can be used for identity theft or fraud.

How the Scam Works: A Step-by-Step Breakdown

Step 1 – The Unsolicited Voicemail

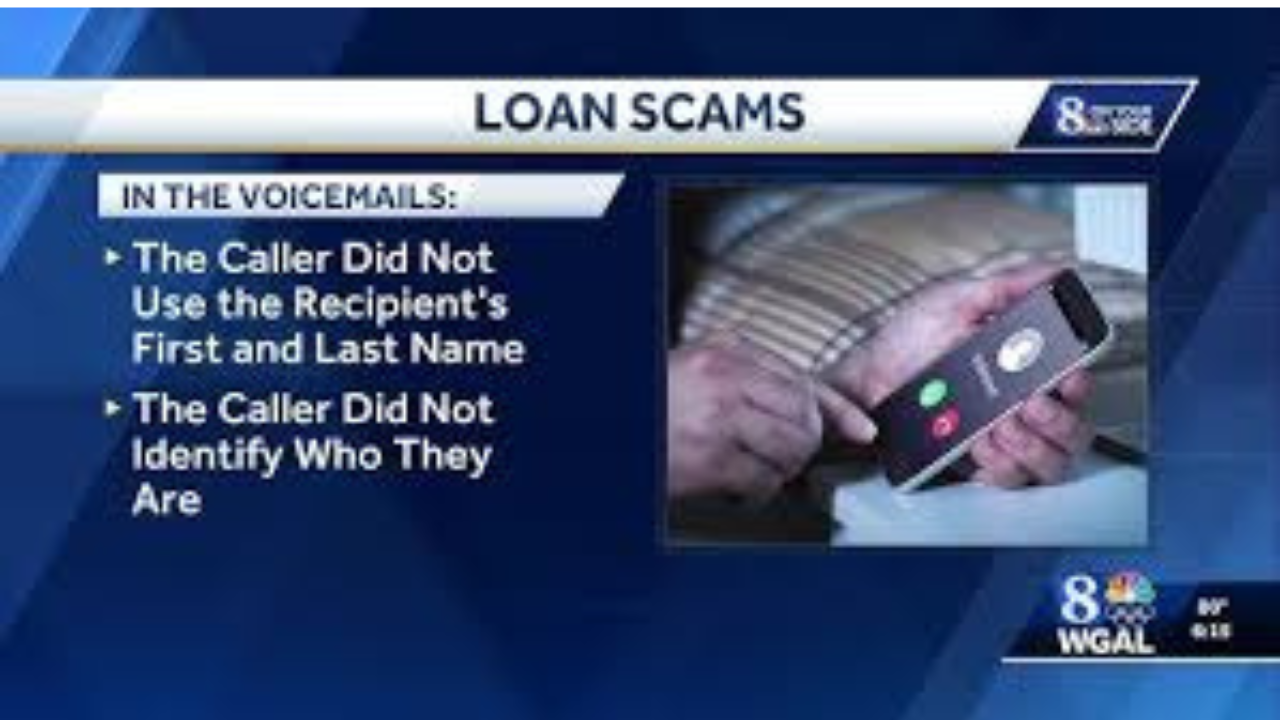

Scammers randomly call individuals, leaving generic voicemails claiming large loans have been pre-approved for them. These voicemails typically omit any personal identifiers such as your first or last name or any legitimate organization information, which is a red flag in itself.

Step 2 – Scare Tactics

The message mentions huge sums, sometimes tens of thousands of dollars, and emphasizes enormous monthly payments. In Dayna’s case, the alleged monthly repayment was over $12,000, designed to provoke fear and urgency.

Step 3 – The Call Back Trap

The scammers hope that alarmed individuals will call the number back, seeking to cancel or clarify the bogus loan. Once you respond, they proceed to ask for sensitive information under the guise of “finalizing” or “cancelling” the supposed loan.

Read about: RightPaydays.com Launches in the USA: Compare Payday & Personal Loans Instantly with Transparency and Speed

How to Protect Yourself from Fake Loan Scams

Do Not Call Back

The most important piece of advice is simple: Do not call the number back. Engaging with these scammers will only result in more calls and potential exposure of your personal information.

Recognize the Warning Signs

- The caller does not mention your name.

- The organization they claim to represent is vague or unidentifiable.

- The message contains suspicious offers like “no origination fee” or “guaranteed approval” without prior application.

- The tone is aggressive or creates an immediate sense of urgency.

Block the Number

Use your phone settings or a third-party call-blocking app to block the number. This will prevent future calls from the same source.

Why Scammers Target Random Individuals

These fake loan scams are typically part of mass robocall campaigns. Scammers do not know who they are calling in advance; their goal is to cast a wide net and capture as many unsuspecting victims as possible. The more people who respond, the more opportunities they have to extract personal information.

In Dayna’s case, she received multiple voicemails of the same type but noticed that none mentioned her name or specific details—clear indications that this was a generic scam.

Also read: Top US Insurance Networks and Alliances for 2025 Revealed: Key Trends Shaping Agent Choices

Conclusion: Stay Alert and Stay Safe

As scam calls increase in frequency, it’s crucial to stay vigilant and know how to respond. These fake loan scams use alarming tactics to create panic and manipulate people into handing over personal data. The best defense is to ignore the voicemail, block the number, and report the incident to the appropriate authorities.

Remember: Legitimate lenders never contact you out of the blue to offer large loans without a prior application or process. If you ever have doubts about your financial accounts, contact your bank or a trusted financial institution directly.

Frequently Asked Questions (FAQ)

1. What should I do if I receive a suspicious loan voicemail?

Do not call back. Do not provide any personal information. Instead, block the number and report the incident to the FTC and FCC. If you’re worried about identity theft, consider monitoring your credit report.

2. How can I tell if a loan offer is legitimate or a scam?

Legitimate lenders require a formal application process, documentation, and credit checks. Scammers often promise guaranteed approval or no fees and do not address you by name or provide verifiable company information.

3. Can ignoring scam calls stop them completely?

While ignoring scam calls helps reduce your exposure, it doesn’t guarantee they will stop. Use call-blocking features or apps, report the numbers, and stay updated on new scam trends.

4. Why do scammers ask for personal information?

Personal information such as Social Security numbers and bank account details are highly valuable to scammers. They use this data for identity theft, unauthorized financial transactions, or to sell it on the dark web.

5. Is there any way to recover personal information once it’s been shared with scammers?

If you suspect you’ve shared sensitive data, immediately contact your bank, credit agencies, and file a report with the FTC. You may also consider placing a fraud alert or credit freeze on your accounts to prevent further misuse.

One thought on “Beware of Fake Loan Scams: Massive Monthly Payments Used to Steal Your Personal Information”